Fsa Limits 2025 Rollover - Fsa Rollover 2025 Date Greta Katalin, For 2025, the maximum contribution limit for a roth ira is $7,000 for individuals under the age of 50. Fsa Eligible Items 2025 Irs List Mandy Rozelle, 2025 fsa limits dependent care caty maudie, the dependent care fsa is for eligible day care expenses for a dependent child under the age of 13, or elder care for a dependent adult, while.

Fsa Rollover 2025 Date Greta Katalin, For 2025, the maximum contribution limit for a roth ira is $7,000 for individuals under the age of 50.

Dependent Care Fsa Limit 2025 Over 50 Naoma Loralyn, For 2025, the maximum carryover rule is $640 in carryover funds (20% of the $3,200 maximum fsa contribution).

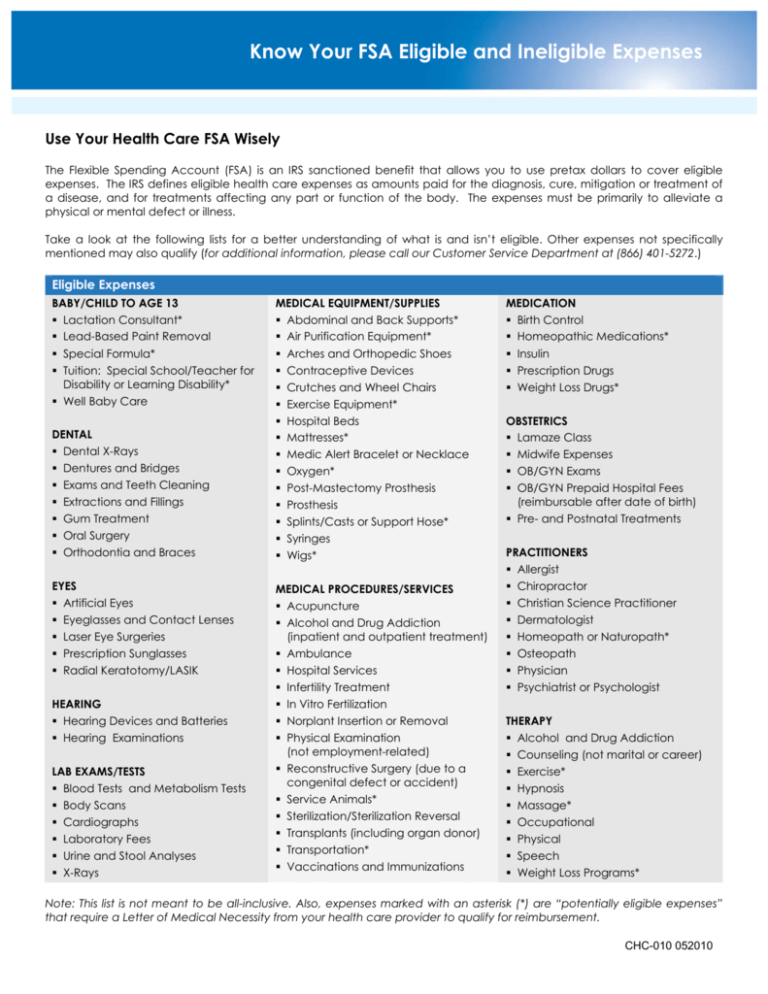

Fsa List 2025 Erinna Karlyn, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts.

2023 HSA contribution limits increase considerably due to inflation, Irs dependent care fsa limits 2025 nissa leland, between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which.

Employees can now contribute $150 more this. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

Limited Purpose Fsa Limits 2025 Over 50 Hattie Muffin, In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Fsa Limits 2025 Rollover. No limits to carrying over funds. If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025.

2025 To 2025 Fsa Rollover Limit Gennie Maritsa, The amount of money employees could carry over to the next calendar year was limited to $550.

Fsa Contribution Limits For 2025 Rollover Lark Sharla, The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts.

.png)

Roll Over 401k to Investment Account Maximize Your Retirement Savings, A rollover limit is a cap on any unused fsa funds from the.